“Finally, A Breath of Relief?” 3 Reasons Home Affordability Is Improving This Fall

Buying a home hasn’t been easy in recent years. High mortgage rates, record-breaking prices, and stretched budgets kept many buyers on the sidelines. But as we head into fall 2025, there are encouraging signs that affordability is starting to improve.

Here are three reasons why the market is shifting — and why this season could open new doors for homebuyers.

1. Mortgage Rates Are Calming Down

Good news: borrowing costs aren’t climbing like they were in 2023 and 2024.

- According to Reuters, the 30-year fixed mortgage rate slipped to an 11-month low this September.

- In forecasting, the National Association of REALTORS® (NAR) expects rates to average around 6% in 2025.

Why this matters: even a small drop in rates lowers monthly payments. NAR states, “If rates stabilize around 6%, about 6.2 million households can once again afford median-priced homes.” For many families, that could mean the difference between “just out of reach” and “doable.”

2. Home Prices Aren’t Climbing as Fast

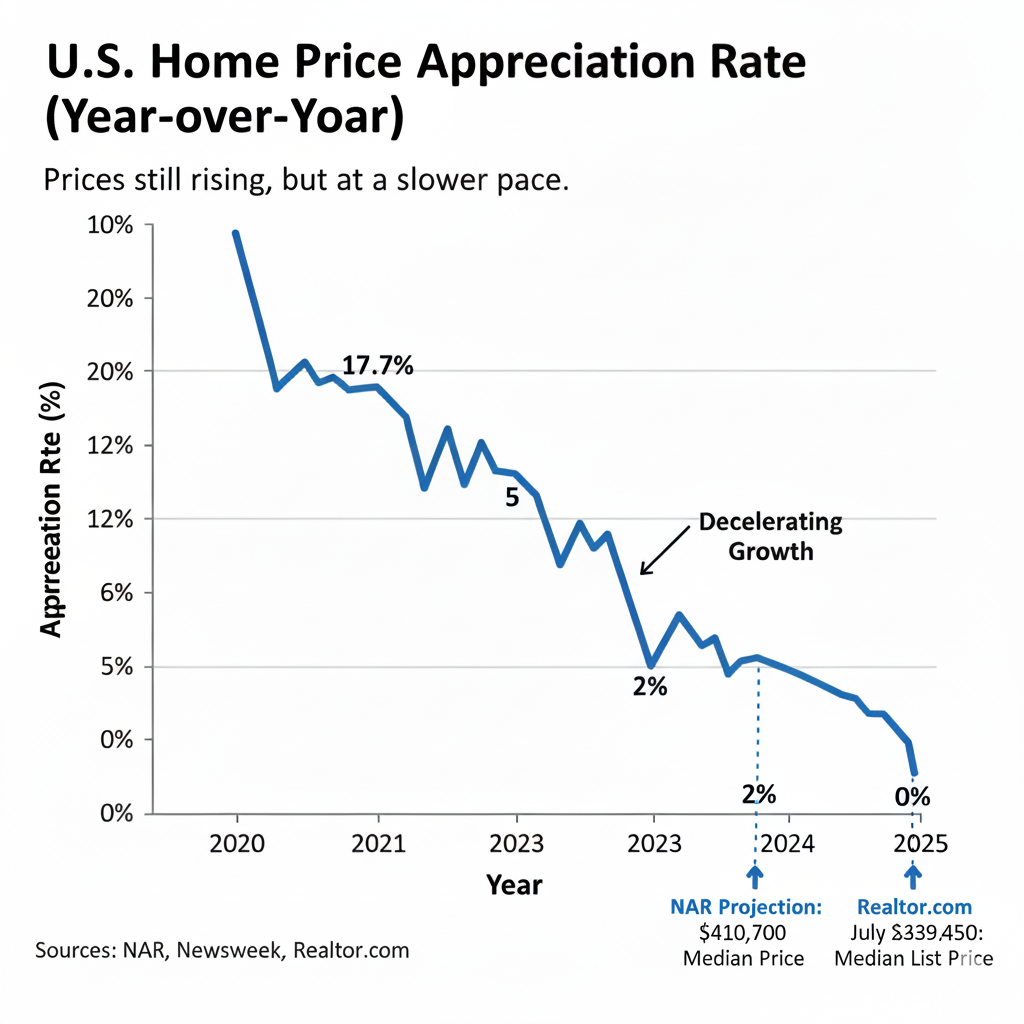

Home prices are still rising, but at a slower pace than before.

- The NAR projects the median home price in 2025 will reach $410,700 in 2025, only 2% higher than last year.

- In Newsweek, analysts commented that “home appreciation will continue to slow down throughout 2025”, even if upward movement persists.

- Realtor.com shows July 2025’s median list price was $439,450, up only 0.5% from last year.

Here’s a look at the trend:

Prices continue to increase, but the pace of growth is slowing. That gives buyers more room to negotiate and less fear of being priced out overnight.

3. Buyers Incomes and Wage Growth Catching Up (Bit by Bit)

Affordability doesn’t depend solely on interest rates or prices — it depends on how far buyer incomes can stretch. This fall, signs suggest buyers have a bit more leverage.

- Ramsey Solutions reminds buyers: “Home prices are driven by supply and demand, and income plays a big role in how far buyers can stretch.”

- Many industries are seeing wages rise faster than inflation, which means buyers are slowly regaining buying power.

- Realtor.com found that with today’s salaries, many buyers can afford more home than just a year ago — especially as rates cool.

Why It All Adds Up

When you combine these trends — lower rates, slower price growth, and stronger wages — the housing market looks a little friendlier than it did last year. It doesn’t mean homes are suddenly inexpensive, but it does mean:

- Payments are getting more manageable

- Buyers have more negotiating power

- Inventory is giving buyers more choices (Realtor.com)

Ready to Take the Next Step?

The market is changing, and this fall could be your window of opportunity. If you’re ready to explore homes, discuss your budget, or devise a specific strategy, don’t go it alone. Contact The Vince Caropreso Team — we’re here to guide your journey, connect you with trusted lenders, and help you find your best path to homeownership in this evolving market. Let’s make fall 2025 the season you get in the door.

Categories

Recent Posts

Prompt and professional service is our guarantee.

Our goal is to be informative and helpful. Through our service we hope to earn your business with our exemplary level of service and extensive local knowledge of the Central Maryland area.